Short-Term Pain for Long-Term Gain

Telemus Weekly Market Review June 6th - June 10th, 2022

On Friday the Bureau of Labor Statistics reported the Consumer Price Index (CPI), the common barometer of inflation, for the month of May. It showed that prices rose 1.0% in the month of May, a higher rate of inflation than expected. Rising food, energy and shelter costs were to blame. In anticipation of Friday morning’s CPI release, stocks sold off during the latter part of Thursday’s session as some investors elected to lighten exposures. Following the release of the May report, stocks continued to fall, with the S&P 500 dropping -2.9% on Friday and ending the week with a loss of -5.1%. The S&P 500 now sits on top of its year-to-date low that was set on May 19th.

In addition to the decline in stocks, the heightened inflation reading also lead to a drop in bond prices as investors concluded the Fed may need to raise interests rates higher and quicker than previously anticipated, resulting in higher Treasury yields. In fact, on Friday alone the yield on the 2-year Treasury rose a quarter of a percent. The yield on the two-year Treasury is now the highest it’s been since 2007.

Stocks and bond prices remain hypersensitive to inflation expectations. While the magnitude of May’s reading was higher than expected, there weren’t any major outliers. What seemed to capture the attention of the media and some investors was the acceleration in the annual rate of inflation, which had shown signs of potentially peaking the past two months. Given what we witnessed with the cost of gasoline, natural gas and food prices this past month, we believed it was premature to think the annual rate of inflation had peaked. In fact, our analysis indicates it’s likely that the 12-month change in the CPI will continue to climb into the fall.

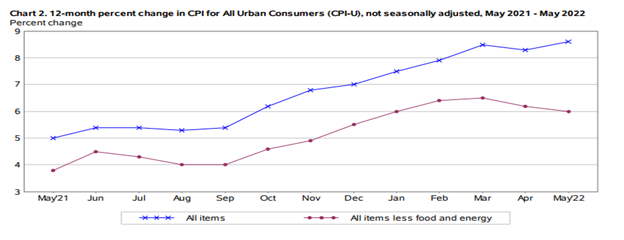

What we do take comfort in is the leveling off in Core CPI. This measure excludes food and energy prices as they tend to be more volatile. As consumers, we can’t exclude these items and they are more than noticeable these days when we go to the supermarket or gas pump. Many of the factors influencing these items are exaggerated by the war in Ukraine. What can be controlled by policy makers is more core items, and those, at present, are leveling off (see the red line in the chart below). It should be noted that core items also include an acceleration in the cost of shelter as well as a 16% increase in airline fares.

Source: Bureau of Labor Statistics. Consumer Price Index – May 2022

This week’s corresponding selloff in stocks is a function of several factors. First, concerns that the Fed will need to react more aggressively to what continues to be elevated inflation. Second, higher bond yields tend to pressure stock price valuations. Lastly, there is becoming greater concern that inflationary pressures and corresponding moves by the Fed will slow the economy and ultimately impact corporate earnings growth. All these concerns are legitimate and while this week’s move was not pleasant, it has now incorporated more muted expectations into prices. Thus, the short-term pain that is being experienced.

As we move forward, we believe the market is being rational in pricing these risks into stocks. Unfortunately, the Fed’s cadence of rate increases has not yet reached a point of having an impact on taming inflation. The war between Russia and Ukraine isn’t making it any easier. As the Fed moves through the summer and implements its expected rate increases, inflation is more likely to begin to ease. We don’t anticipate exiting the year back at the 2% long-term inflation target, but we think it’s reasonable to be on a downtrend from where we are today. At that point, bond investors will be earning higher yields and have a much more attractive long-term return profile. In addition, stock price multiples, which had been higher relative to historic norms, are now back inline with long-term averages. Thus, we are becoming more constructive on the long-term return expectations for stocks as well. In the interim, the market will be volatile as it reacts to news and shifting expectations around inflation, interest rates, economic growth, and corporate earnings. As we work through this period of short-term pain, we are optimistic about the long-term gain that is on the horizon.

All opinions expressed in this article are for general informational purposes and constitute the judgment of the author(s) as of the date of the report. These opinions are subject to change without notice and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material has been gathered from sources believed to be reliable, however Telemus Capital cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS. Investment decisions should always be made based on the client's specific financial needs, goals and objectives, time horizon and risk tolerance. Current and future portfolio holdings are subject to risk. Risks may include interest-rate risk, market risk, inflation risk, deflation risk, currency risk, reinvestment risk, business risk, liquidity risk, financial risk, and cybersecurity risk. These risks are more fully described in Telemus Capital's Firm Brochure (Part 2A of Form ADV), which is available upon request. Telemus Capital does not guarantee the results of any investments. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, and may lose value.

Advisory services are only offered to clients or prospective clients where Telemus and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Telemus unless a client service agreement is in place. All composite data and corresponding calculations are available upon request.

Matt joined the Telemus team in 2018. As Chief Investment Officer, he leads the firms the investment process and research effort. Matt has experience as an equity analyst and portfolio manager and has advised corporate pension plans on their manager selection. He’s been quoted in Money Magazine and Barron’s.