Guarded Growth

Telemus Weekly Market Review January 16th - January 20th, 2023

After a turbulent year for growth stocks in 2022, how has sentiment shifted for 2023?

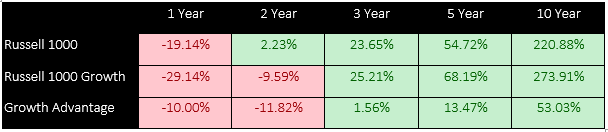

The Russell 1000 Growth Index is the common benchmark measuring the performance of the large-cap growth segment of the US equity universe. The index was down -29.14% compared to the Russell 1000 at -19.14% in 2022. The growth segment of the equity market is traditionally defined as companies with above average earnings growth rates that also trade at above average valuations. The underperformance of growth stocks in 2022 was a function of the Federal Reserve hiking interest rates as a measure to tame inflation, which consequently makes borrowing more expensive for companies that need cash influxes to expand their growing businesses. With more hikes forecasted in 2023, is it wise to keep existing investments in growth stocks or to add new positions?

When we’re determining exposure to growth stocks, we always try to keep a long-term lens of at least five years. With the overall stock market volatility and economic uncertainties during shorter timeframes, it’s unrealistic to try to time moving into or out of the growth segment of the market. As you can see from cumulative returns in the table below, the Russell Growth Index has underperformed the broader Index when you look at shorter time frames. However, it’s common during spans of 5-plus years that growth outperforms.

Source: Bloomberg. Data as of 12/31/22.

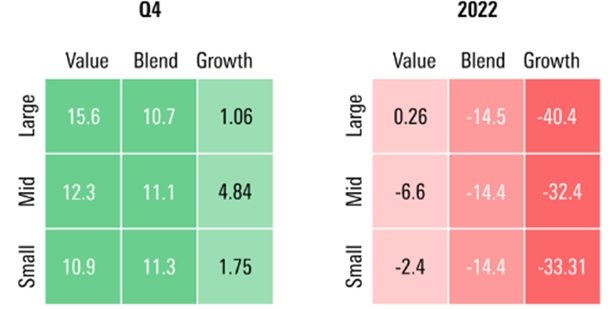

There has been a clear sentiment shift favoring value stocks across all market capitalizations of late, as seen in the Morningstar Equity Style box returns shown below through December 31, 2022. On top of the increase in interest rates dampening growth companies’ ability to borrow, we’re seeing increased announcements of layoffs, especially in big tech growth names, which we see as a sign that their executives know they are going to have financial challenges in the near term.

Although value has roared back, there are pockets of the growth style that we believe can still outperform. We see the most attractive part of the growth segment being companies that are migrating closer to the mature phase of their corporate life cycle. These are companies with expanding operating margins and stronger cash flow generation supporting high levels of reinvestment back into the business. These companies have market leadership, clear points of differentiation versus competitors and are still innovating. This differs than in previous years where the market favored earlier stage growth businesses, that may not have been profitable or have established markets.

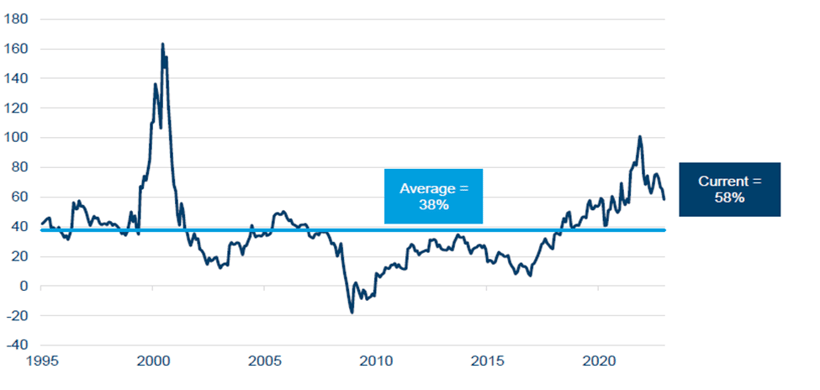

We expect the storm for growth stocks to lessen in 2023. In fact, through the first three trading weeks, growth stocks have outperformed value by roughly 1%. Nonetheless, given what are still slightly stretched valuations for growth versus value (as seen in the final chart below), a more challenging backdrop for corporate fundamentals, and more favorable sentiment toward value stocks, we aren’t projecting a swift rebound for the style. However, we do believe we are entering an environment where stock selection decisions become more paramount and expect there to be several individual growth stocks that stand out, especially when viewed through a long-term lens.

Forward P/E Ratio: Russell 1000 Growth relative to Russell 1000 Value

Source: Columbia Threadneedle Investments, Bloomberg. Data as of 12/30/22

All opinions expressed in this article are for general informational purposes and constitute the judgment of the author(s) as of the date of the report. These opinions are subject to change without notice and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material has been gathered from sources believed to be reliable, however Telemus Capital cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS. Investment decisions should always be made based on the client's specific financial needs, goals and objectives, time horizon and risk tolerance. Current and future portfolio holdings are subject to risk. Risks may include interest-rate risk, market risk, inflation risk, deflation risk, currency risk, reinvestment risk, business risk, liquidity risk, financial risk, and cybersecurity risk. These risks are more fully described in Telemus Capital's Firm Brochure (Part 2A of Form ADV), which is available upon request. Telemus Capital does not guarantee the results of any investments. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, and may lose value. Any reference to an index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products.

Advisory services are only offered to clients or prospective clients where Telemus and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Telemus unless a client service agreement is in place. All composite data and corresponding calculations are available upon request.