The Impact of Geopolitical Events on Stocks

Telemus Weekly Market Review October 23rd - October 27th, 2023

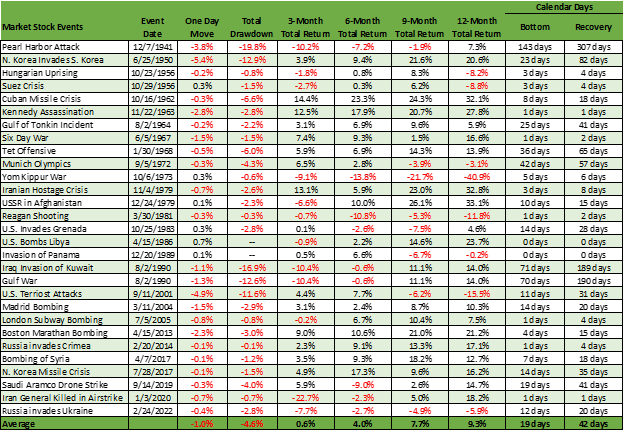

Contentious conflicts can bring out the worst in people. As a Firm, we are choosing to bring out the best in one another and our community. As investors and ultimately, as fiduciaries of client assets, we remain disciplined despite a natural human reaction to world events. The situation in Israel is serious and a risk to further escalation remains, however, prior geopolitical events have shown little lasting impact on U.S. economic fundamentals and corporate profits. Telemus has complied data and looked back at different types of geopolitical conflicts dating back to World War II. While each has unique circumstances, an initial negative market reaction tends to prove rather transitory. The chart below illustrates data from 29 such events. On average, the S&P 500 declined nearly 5%, but then more often than not was higher 3, 6, 9, and 12 months later. Further, on average prior drawdowns tend to last 19 calendar days and a full price recovery has historically occurred by the 42nd day.

Source: LPL Research, S&P Dow Jones Indices, CFRA, Telemus, Bloomberg. Past performance doesn’t guarantee future results. The illustrated returns are reflective of the performance under the stated timeframe for the S&P 500 Index and beginning with the “event date”. The S&P 500 index is a stock market index that tracks performance of 500 U.S.-based large-cap companies from various sectors. It is widely considered a gauge of investor sentiment and its returns reflect the state of the American economy.

This analysis is helpful in illustrating that geopolitical events typically have an impact on returns, but they tend to resolve reasonably quickly. However, we would add that there are always multiple factors influencing markets at any given time. Therefore, one can’t attribute the return of the market to one event in isolation.

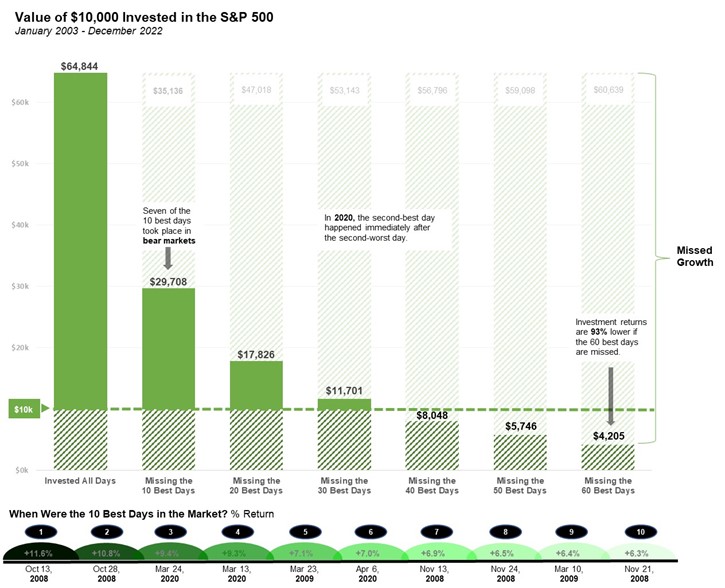

We are hopeful that the conflict in the Middle East will deescalate quickly, but from an investment perspective, we would like to remind clients that ‘Time in the Market’ is more important that ‘Timing in the Market’. As noted above, geopolitical events have a historical precedent for causing stressful market conditions, which tends to spur heightened volatility, both to the downside and to the upside. As the chart below depicts, missing just a few of the best days in the market can have a devastating impact on long-term outcomes. While praying for all those affected by the recent global tragedy, we’d encourage rational investment decisions driven by an individual’s unique goals.

Source: JP Morgan & Visual Capitalist, S&P 500 Index total returns from January 1st, 2003 to December 31st, 2022.

All opinions expressed in this article are for general informational purposes and constitute the judgment of the author(s) as of the date of the report. These opinions are subject to change without notice and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material has been gathered from sources believed to be reliable, however Telemus Capital cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS. Kovitz Investment Group Partners, LLC (“Kovitz”) DBA Telemus Capital. Telemus Capital is a division of Kovitz, a registered investment adviser with the Securities and Exchange Commission (SEC). Telemus Capital’s main office is located in Southfield, Michigan. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability. Investment decisions should always be made based on the client's specific financial needs, goals and objectives, time horizon and risk tolerance. Current and future portfolio holdings are subject to risk. Risks may include interest-rate risk, market risk, inflation risk, deflation risk, currency risk, reinvestment risk, business risk, liquidity risk, financial risk, and cybersecurity risk. These risks are more fully described in Telemus Capital's Firm Brochure (Part 2A of Form ADV), which is available upon request. Telemus Capital does not guarantee the results of any investments. Investment, insurance, and annuity products are not FDIC insured, are not bank guaranteed, and may lose value. Any reference to an index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. The S&P 500 index includes 500 leading companies in the US and is widely regarded as the best single gauge of large-cap US equities.

Advisory services are only offered to clients or prospective clients where Telemus Capital and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Telemus Capital unless a client service agreement is in place.