The Pressure on Equities

Telemus Weekly Market Review April 25th - April 29th, 2022

This past week the Bureau of Economic Research announced that the U.S. economy contracted by -1.4% in the first quarter. The surprise deceleration, alongside rising concerns around the ability for companies to maintain their level of profit margins began to weigh on investor sentiment. A sizable drop on Friday, where the S&P 500 fell by -3.6%, led to a down week where the S&P 500 lost -3.3%.

The release of the 1st quarter Gross Domestic Product (GDP) showed a surprising decline in economic activity. The key factor driving the softness was a reduction of inventories, which followed an exceptionally strong fourth quarter 2021 when inventories rose at a stronger rate than expected. Inventories can be unpredictable and supply chain challenges add to the volatility. Thus, one has to consider the -1.4% decline in 1st quarter GDP alongside a better than forecast +6.9% rise in the 4th quarter of last year. Aside from the drawdown in inventories and another record setting trade deficit, healthy consumer spending and positive business investment demonstrated resilience for a bulk of the quarter’s economic activity.

Aside from the first quarter GDP report, this week’s news flow centered around first quarter earnings reports. This was the busiest week for S&P 500 companies to report earnings, with the large technology stalwarts all reporting. While in aggregate earnings results have been strong, we’ve begun to see some companies warn of softness on the horizon, a tone that only excites investors concerned with prospect of potential margin pressures.

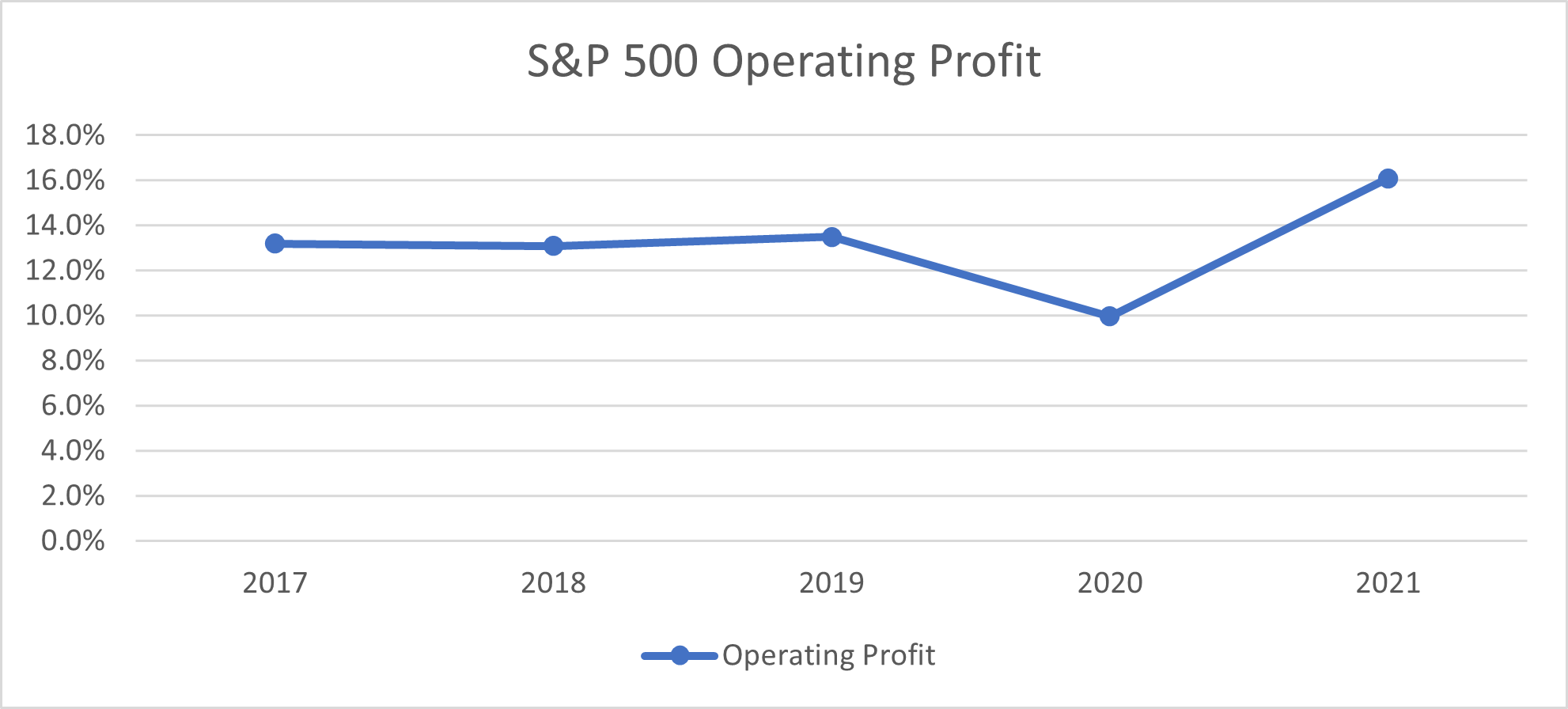

We do see risks to margins. Corporate profit margins are at peak levels, well ahead of previous peaks experienced before the pandemic (see the chart below). Companies continue to grapple with staffing challenges, which will inevitably impact productivity. In addition, with inflation elevated there is no certainty that companies will be able to pass cost pressures along without impacting sales volumes. As such, it’s not unreasonable to assume margins compress to some degree during the back half of 2022.

Source: Bloomberg, Standard & Poor’s

Source: Bloomberg, Standard & Poor’s

This week’s GDP data provided evidence that consumers are shifting their behavior away from goods back toward services. Based on the data provided by the Bureau of Economic Research, consumers consumption of goods has expanded by 17% since 2019, while spending on services is down nearly 4%. As spending patterns return to normality, we’d expect purchases of goods, particularly large ticket items, to ease in favor or more spending on services such as travel, entertainment and even healthcare. A broader recognition of this transition resulted in the consumer discretionary sector falling nearly -8% this past week, making it the weakest sector in the S&P 500.

Looking ahead, the market’s attention will be on the Federal Reserve which meets on Tuesday and Wednesday. It’s a foregone conclusion that the Fed will increase the overnight federal funds rate by at least a half a percent, with odds of a three-quarter point increase on the rise. One area of uncertainty will be on whether the Fed begins to reduce its balance sheet immediately or hold off on starting the so called ‘quantitative tightening’ process until its meeting in June.

All opinions expressed in this article are for general informational purposes and constitute the judgment of the author(s) as of the date of the report. These opinions are subject to change without notice and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material has been gathered from sources believed to be reliable, however Telemus Capital cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS. Investment decisions should always be made based on the client's specific financial needs, goals and objectives, time horizon and risk tolerance. Current and future portfolio holdings are subject to risk. Risks may include interest-rate risk, market risk, inflation risk, deflation risk, currency risk, reinvestment risk, business risk, liquidity risk, financial risk, and cybersecurity risk. These risks are more fully described in Telemus Capital's Firm Brochure (Part 2A of Form ADV), which is available upon request. Telemus Capital does not guarantee the results of any investments. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, and may lose value.

The S&P 500® is widely regarded as the best single gauge of large-cap U.S. equities. There is over USD 11.2 trillion indexed or benchmarked to the index, with indexed assets comprising approximately USD 4.6 trillion of this total. The index includes 500 leading companies and covers approximately 80% of available market capitalization. An index is not a security in which an investment can be made, as they are unmanaged vehicles that serve as market indicators only and do not account for the deduction of management fees and/or transaction costs generally associated with investable products. Advisory services are only offered to clients or prospective clients where Telemus and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Telemus unless a client service agreement is in place. All composite data and corresponding calculations are available upon request.

Matt joined the Telemus team in 2018. As Chief Investment Officer, he leads the firms the investment process and research effort. Matt has experience as an equity analyst and portfolio manager and has advised corporate pension plans on their manager selection. He’s been quoted in Money Magazine and Barron’s.