Telemus Weekly Market Review September 27th - October 1st, 2021

The Growth and Value Divide

Nearly two weeks ago, the Federal Reserve announced that they would soon begin to slow their pace of monthly asset purchases (i.e. tapering). In addition, forecasts from the members of the Federal Open Market Committee (FOMC) indicated that half expected the Fed would increase interest rates in 2022. This announcement was followed the next day by similar rhetoric out of the Bank of England.

What has transpired since has been a significant shift in the types of assets leading the market. Among stocks, there has been a notable shift away from so-called growth stocks. Stocks are classified as growth when their sales and earnings are expected to grow at a much faster rate than market averages. Growth stocks had been outpacing their value brethren on the year and had been doing so in a meaningful way over the last number of years. Keep in mind value stocks are those that tend to trade at valuation multiples that are below that of the broader market. They typically include stocks in sectors such as financials, industrials, and basic materials.

The recent shift away from growth and toward value is fueled by the prospect of higher rates. Not just from the Fed potentially increasing short-term rates, but some expect long-term rates to increase as the Fed begins to exit its participation in the Treasury market. Higher interest rates benefit value stocks over growth in a couple of ways. First, value stocks tend to be more interest rate sensitive and sectors such as financials benefit from making greater income off higher interest rates. Second, growth stocks may be negatively impacted from higher rates as the mathematics of discounting prescribe less value to their future earnings. Given that more of the value in growth names comes from expectations of their revenue and earnings well into the future, changes in interest rates can have a disproportionate impact on growth stocks.

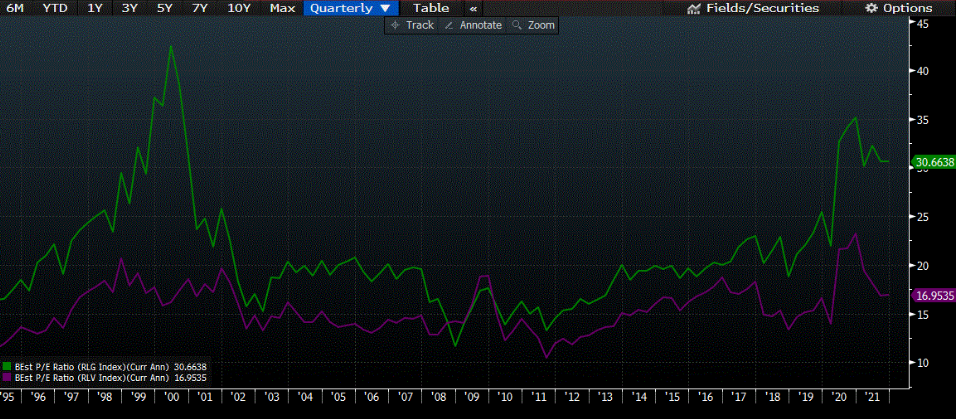

Since the start of the pandemic, we’ve seen many of the stalwart, growth-oriented technology companies only get stronger. Given the improvement in business fundamentals, there is clearly justification for the higher valuations that these companies have achieved. As the market rally has progressed, we are seeing an outsized divergence in the valuations that investors are willing to pay for these growth-oriented businesses. The chart below plots the historic price/earnings multiple of the Russell 1000 Growth (green line) and Russell 1000 Value (purple line) indices. These indices represent common large cap growth and large cap value benchmarks.

Source: Bloomberg

Source: Bloomberg

As evidenced from this chart, the valuations on growth stocks have become stretched to levels not witnessed since the late 1990’s tech bubble. Value stocks, on the other hand, have seen their multiples retrace from early 2021 levels and are now back in line with historic averages. This bifurcation is worth noting as much is discussed about market multiples trading at above-average levels. While this is true, it doesn’t apply to all stocks.

We believe that now is the time to have a balance in portfolios. Having an entire stock portfolio that is biased toward growth stocks can leave one susceptible to mean reversion in prices should value stocks enter a sustained rally. On the other hand, there are clearly some attractive secular shifts occurring around technology, ecommerce, electric vehicles among others. Therefore, its important to recognize there is some validity to growth-oriented stocks trading at above-average valuations. Given these considerations, we believe it’s prudent at this stage of the market cycle to have a balanced mix of growth and value stocks.

All opinions expressed in this article are for general informational purposes and constitute the judgment of the author(s) as of the date of the report. These opinions are subject to change without notice and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material has been gathered from sources believed to be reliable, however Telemus Capital cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS. Investment decisions should always be made based on the client's specific financial needs, goals and objectives, time horizon and risk tolerance. Current and future portfolio holdings are subject to risk. Risks may include interest-rate risk, market risk, inflation risk, deflation risk, currency risk, reinvestment risk, business risk, liquidity risk, financial risk, and cybersecurity risk. These risks are more fully described in Telemus Capital's Firm Brochure (Part 2A of Form ADV), which is available upon request. Telemus Capital does not guarantee the results of any investments. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, and may lose value.

The Russell 1000® Growth Index measures the performance of the large-cap growth segment of the US equity universe. It includes those Russell 1000® companies with higher price-to-book ratios and higher forecasted growth values. The Russell 1000® Value Index measures the performance of the large-cap value segment of the US equity universe. It includes those Russell 1000® companies with lower price-to-book ratios and lower expected growth values. Both the Russell 1000® Growth Index and the Russell 1000® Value Index are constructed to provide comprehensive and unbiased barometers for the large-cap growth segment. The indices are completely reconstituted annually to ensure new and growing equities are included and that the represented companies continue to reflect growth characteristics.

Advisory services are only offered to clients or prospective clients where Telemus and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Telemus unless a client service agreement is in place. All composite data and corresponding calculations are available upon request.

Matt joined the Telemus team in 2018. As Chief Investment Officer, he leads the firms the investment process and research effort. Matt has experience as an equity analyst and portfolio manager and has advised corporate pension plans on their manager selection. He’s been quoted in Money Magazine and Barron’s.