Will the Fed Pivot?

Telemus Weekly Market Review January 23rd - January 27th, 2023

This coming week the Federal Reserve’s Federal Open Market Committee (FOMC), the interest rate setting body of the Fed, will meet to consider further interest rate increases. The consensus expectation is that the FOMC will raise the federal funds rate by 0.25%. After downshifting from 0.75% rate increase in November to 0.50% in December, the expectation is that the Fed will continue to slow its magnitude of increase at this meeting.

Since the last FOMC meeting we’ve seen further deceleration in industrial activity, with both manufacturing and services declining. New orders provide little hope of improvement. Retail spending in the month of December was notably softer than expected. Housing activity continues to slow with home prices under pressure. Offsetting this, however, is what continues to be a strong employment market. Wage growth remains elevated growing 4.6% of the past year, however the rate of growth has been coming down. In addition, consumer sentiment continues to improve having bottomed in June. A key reason being the steady downtrend in inflation, which now sits at 6.5% annual rate, having been as high as 9.1% in June.

The market has assembled these pieces with the view that a slowing economy and moderating inflation will lead the Fed to not only slow but soon halt their rate hiking campaign. At the December FOMC meeting, which took place six weeks ago, the median expectation among members was for another 0.75% more of rate increases during 2023, with no member expecting any rate cuts before year end. The fed funds futures markets, which allows investors to speculate on where the fed funds rate will end up, implies roughly two, 0.25% rate increases in 2023. In fact, the fed fund futures market implies greater than 50% odds of a rate cut in the 4th quarter of 2023. Thus, the market is expecting a pivot, or change in stance by the Fed.

One could argue that the deceleration in the rate of inflation, softening industrial activity, and slower consumer spending supports a change in stance by the Fed. However, the strength of the employment market and what remains an elevated level of wage growth indicates there remains a high risk of inflation reigniting. This is important as historically episodes of inflation have not been one and done. The Fed is well aware of this having fumbled through the 1970’s. Recent research by the Bank of International Settlements¹, the central bank for central banks, furthers this view noting that front loading rate hikes tends to be successful in countering inflation.

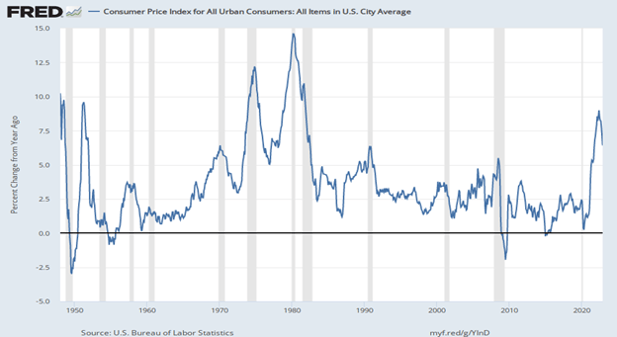

Figure 1

Source: FRED Economic Data - St. Louis Federal Reserve, U.S. Bureau of Labor Statistics

The chart above depicts the annualized rate of inflation (as measured by the Consumer Price Index). As one can see coming out of World War II and during the 1970’s there were multiple episodes of rising inflation. The reason this pattern has occurred in the past is that central banks have raised rates to combat inflation. Once inflation begins to cool, they reverse course lowering rates and pent up demand returns igniting another bout of inflation.

We believe the Fed recognizes this risk and rhetoric out of nearly all members of the FOMC indicates they are comfortable with the economy slowing and incurring some pain to quell inflation in a once and done manner. Stock and bond markets, on the other hand, are pricing in a Fed pivot. We’ve found market action thus far in 2023 as having been rather perverse, as weak economic data has been cheered with lower rates and higher stock prices based on the view that it supports a less hawkish Fed. We see limited relevance in whether the Fed raises rates by 0.50% or 1.0% in 2023. The bigger impact is whether rates stay higher for longer. If the Fed sticks to its message, markets will have to adjust and revert back to higher rate expectations. Should the Fed flinch and indicate they might ease policy this year, we don’t expect a significant move as markets have already priced this in. Thus, we don’t think its prudent to speculate on a Fed pivot as the upside is limited. However, focusing on investments that will perform with the Fed holding firm on its forecasts offers the best risk/reward from our perspective.

¹ Cavellino, Cornelli, Hordahl andZakrajsek, “Front-loading monetary tightening: pros and cons.” BIS Bulletin No. 63, December 9, 2022.

All opinions expressed in this article are for general informational purposes and constitute the judgment of the author(s) as of the date of the report. These opinions are subject to change without notice and are not intended to provide specific advice or recommendations for any individual or on any specific security. The material has been gathered from sources believed to be reliable, however Telemus Capital cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS. Investment decisions should always be made based on the client's specific financial needs, goals and objectives, time horizon and risk tolerance. Current and future portfolio holdings are subject to risk. Risks may include interest-rate risk, market risk, inflation risk, deflation risk, currency risk, reinvestment risk, business risk, liquidity risk, financial risk, and cybersecurity risk. These risks are more fully described in Telemus Capital's Firm Brochure (Part 2A of Form ADV), which is available upon request. Telemus Capital does not guarantee the results of any investments. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, and may lose value. Any reference to an index is included for illustrative purposes only, as an index is not a security in which an investment can be made. Indices are unmanaged vehicles that serve as market indicators and do not account for the deduction of management fees and/or transaction costs generally associated with investable products.

Advisory services are only offered to clients or prospective clients where Telemus and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Telemus unless a client service agreement is in place. All composite data and corresponding calculations are available upon request.

Matt joined the Telemus team in 2018. As Chief Investment Officer, he leads the firms the investment process and research effort. Matt has experience as an equity analyst and portfolio manager and has advised corporate pension plans on their manager selection. He’s been quoted in Money Magazine and Barron’s.