Asset Allocation vs. Tax Diversification

Financial Advisors can agree that a diversified portfolio is crucial in design and important to monitor on a regular basis so that the asset allocation still meets client objectives. Two common terms that often come up in investing discussions are asset allocation and tax diversification. While they may sound similar, they have distinct meanings and purposes.

Asset allocation refers to the process of dividing an investment portfolio among different asset classes, such as stocks, bonds, and cash, based on goals, risk tolerance, and time horizon. The goal of asset allocation is to diversify investments and balance risk and reward. By investing in a variety of assets, you can reduce the impact of any single investment's performance on an overall portfolio. A well-diversified portfolio can help weather market fluctuations and achieve both short and long-term financial goals.

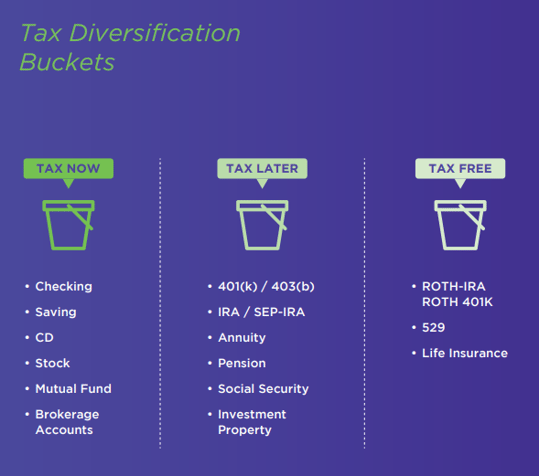

Tax Diversification is the process of strategically placing investments into different account types to minimize the tax liability. It involves allocating assets into taxable, tax-deferred, and tax-free accounts. Each has different tax implications, and the tax rules can vary depending on the asset class. Understanding the difference between asset allocation and tax diversification is critical in developing a solid investment plan. While asset allocation is about diversifying your investments across different asset classes, tax diversification focuses on managing your tax liability through different types of investments.

One of the biggest uncertainties is not knowing what the future tax rates will be. This can be a daunting prospect, as tax rates can significantly affect investment returns and ultimately, your financial well-being. However, there are strategies that can be

implemented to invest effectively, regardless of the unknown future tax rates.

If you feel that tax rates are expected to increase in the future, you may want to consider shifting your portfolio to tax-advantaged investments to reduce your overall tax liability.

TAX NOW — Taxable accounts include brokerage accounts, savings accounts, and CDs. Income generated from these accounts, such as dividends and interest, are subject to taxes every year. However, capital gains taxes are only due when assets are sold.

TAX LATER — Tax-deferred accounts include traditional IRAs and 401(k)s. These pre-tax contributions made reduces taxable income for the year and grow tax-free until withdrawal. However, withdrawals are subject to ordinary income tax with penalties for early withdrawal.

TAX FREE — Tax-free accounts include Roth IRAs and Roth 401(k)s. Contributions made to these accounts made after tax, but the investments grow tax-free, and withdrawals are not subject to taxes, provided certain criteria are met.

To effectively allocate assets for tax purposes, investors must consider their current tax bracket, future income projections, and retirement goals. They should also consider the tax implications of rebalancing their portfolio and the impact of required minimum distributions (RMDs) on tax-deferred accounts.

To ensure that your investment strategy aligns with your goals and risk tolerance, it is crucial to work with a team of professionals who can help you design a solid plan. Our team of experts can help you navigate the complexities of asset allocation and tax diversification to create a personalized plan that meets your unique needs.

The information provided is general and educational in nature and should not be construed as personalized investment, tax, or insurance advice. You should consult with your own tax or insurance advisor regarding your personal situation. The statements contained herein are based solely upon the opinions of Telemus Capital, LLC. All opinions and views constitute our judgments as of the date of writing and are subject to change at any time without notice. Information was obtained from third party sources, which we believe to be reliable, however Telemus Capital cannot guarantee the accuracy or completeness of such information, and certain information presented here may have been condensed or summarized from its original source. PAST PERFORMANCE IS NOT A GUARANTEE OF FUTURE RESULTS. Insurance and investment decisions should always be made based on the client’s specific financial needs, goals and objectives, time horizon and risk tolerance. Current and future portfolio holdings are subject to risk. Risks may include interest-rate risk, market risk, inflation risk, deflation risk, currency risk, reinvestment risk, business risk, liquidity risk, financial risk and cybersecurity risk. These risks are more fully described in Telemus Capital’s Firm Brochure (Part 2A of Form ADV), which is available upon request. Telemus Capital does not guarantee the results of any investments. Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, and may lose value. Advisory and Insurance services are only offered to clients or prospective clients where Telemus Capital and its representatives are properly licensed or exempt from licensure. No advice may be rendered by Telemus Capital unless a client service agreement is in place.

Todd joined Telemus in November 2022 after 28 years serving in multiple roles in the insurance industry. He has been an Independent Insurance Agent, Brokerage Manager, and also Regional Vice President for two Fortune 500 Life Insurance Companies. Todd is a proud Alumni of Michigan State University and continues to learn as a student of the industry earning both his Chartered Financial Consultant (ChFC) and Certification in Long Term Care (CLTC) designations.