Fed Interest Rate Policy: What’s Next for 2025?

As we enter the second half of 2025, the Federal Reserve’s interest rate policy remains a focal point for investors, policymakers, and everyday consumers alike. After a period of elevated rates aimed at curbing inflation, all eyes are now on the Fed’s next move—will they pivot to rate cuts, hold steady, or tighten further?

Let’s explore the current landscape and what the outlook could mean for the broader economy.

Our Path Here: From Inflation Control to Policy Pause

Since early 2022, the Fed has aggressively raised the federal funds rate in an effort to combat the worst inflation in decades. At its peak, the benchmark rate hovered above 5.25%, creating ripple effects across credit markets, mortgages, and consumer borrowing.

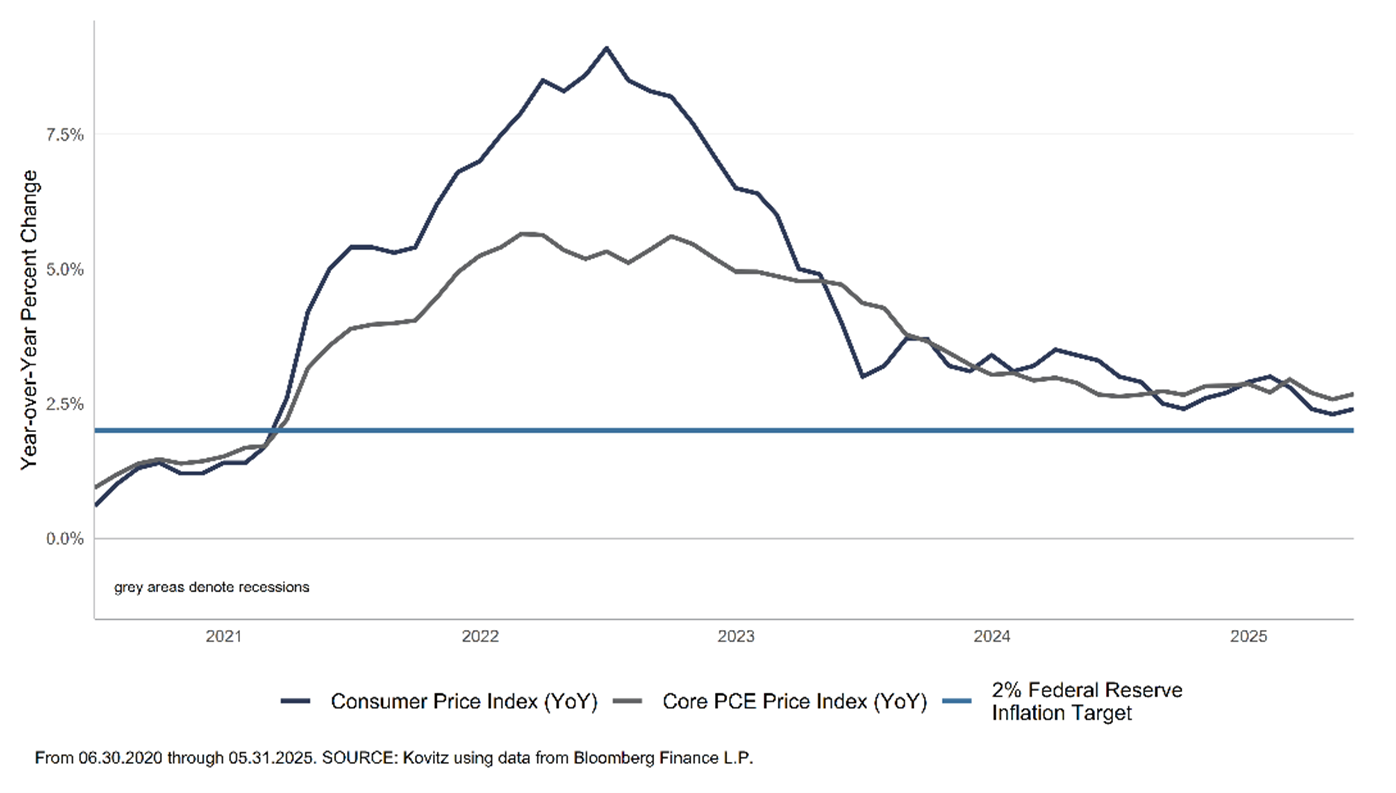

However, inflation has cooled considerably over the past year. The Fed's preferred inflation gauge—the Core PCE (Personal Consumption Expenditures) index—has gradually moved closer to the 2% target, giving policymakers more room to maneuver.

The 2025 Landscape: Cooling Inflation, Slowing Growth

Several key data points are shaping the Fed's outlook:

- Inflation: Core inflation is trending toward 2.5%, down from over 6% just two years ago. While still above target, the trend has been encouraging.

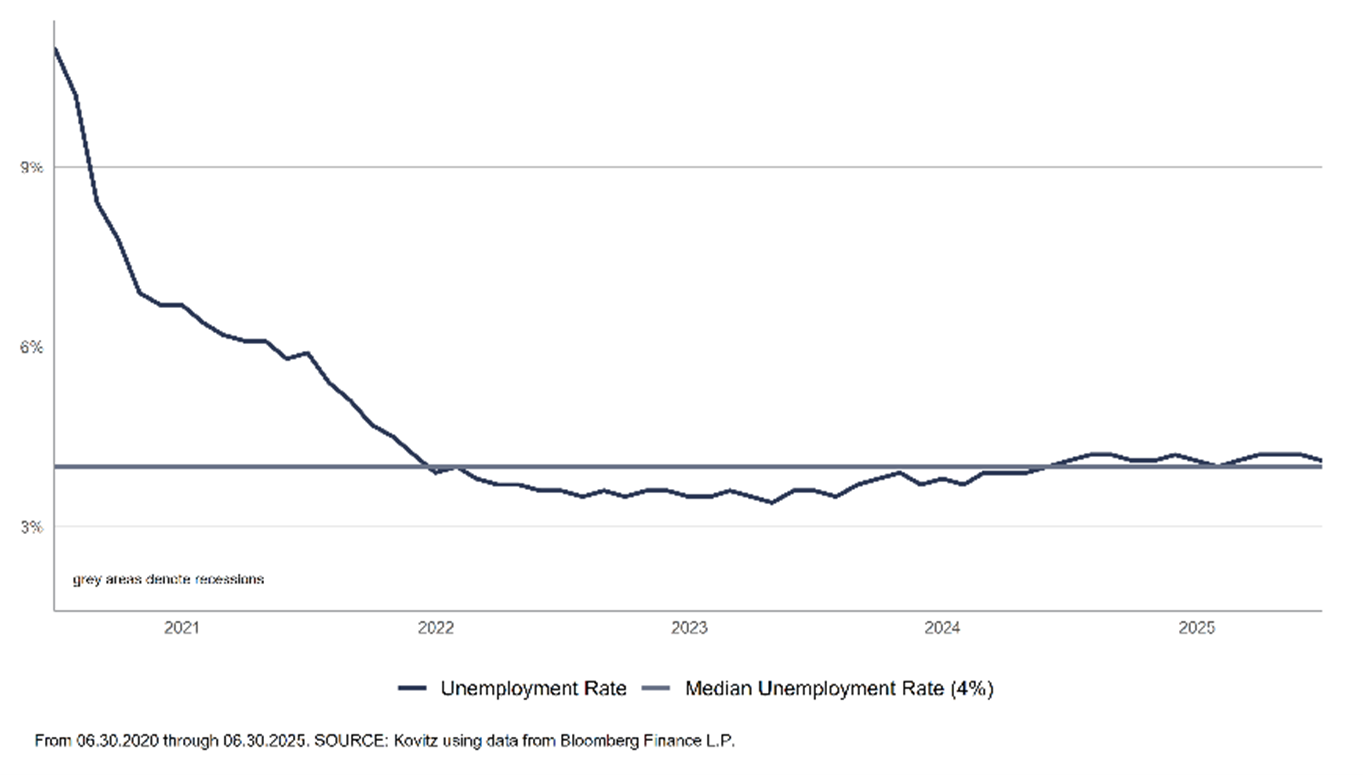

- Labor Market: Job growth remains positive, though wage growth has moderated. Unemployment has ticked up slightly but remains historically low.

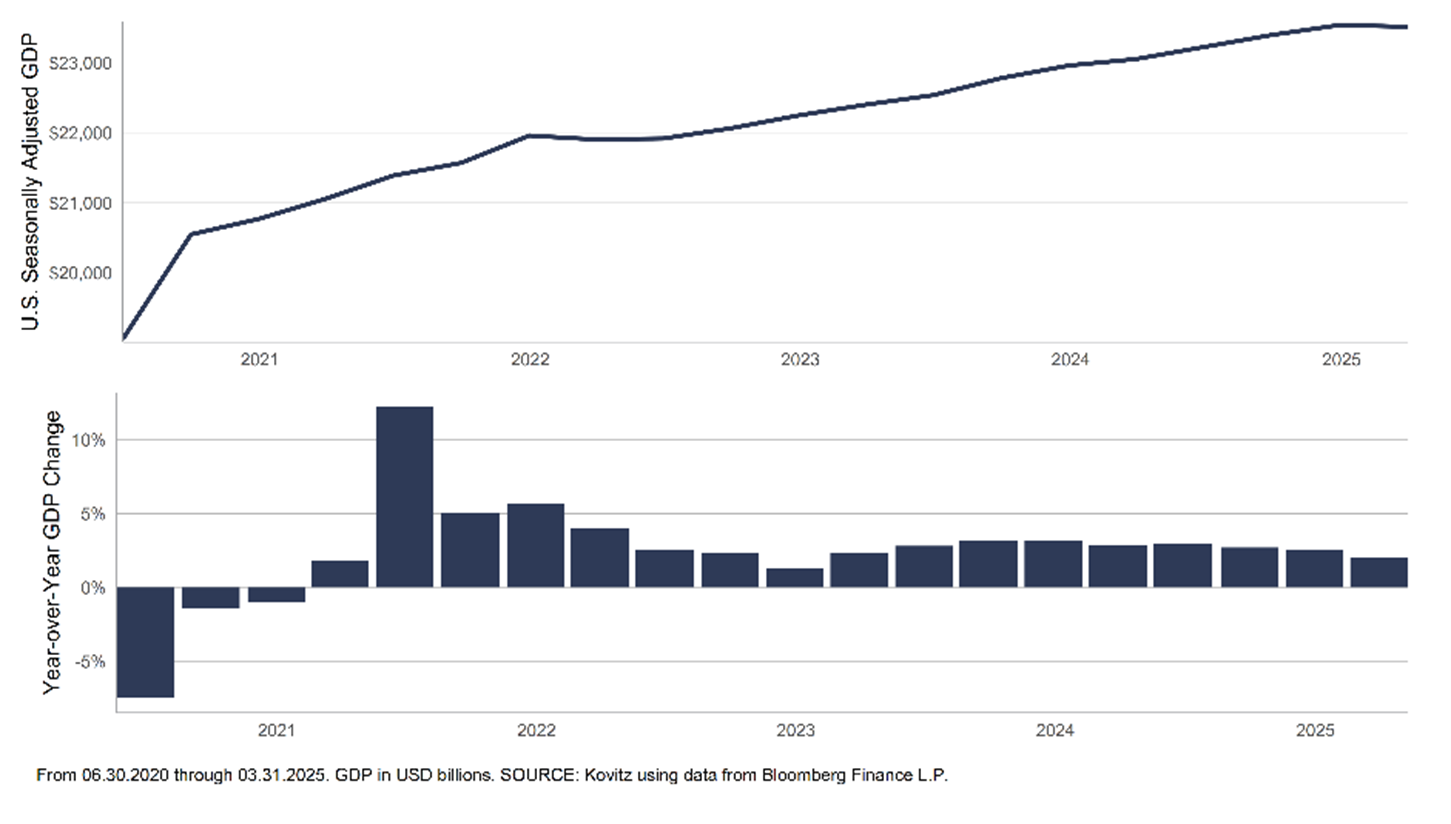

- GDP Growth: Economic growth has slowed to a more sustainable pace—hovering around 1.5-2%—suggesting the Fed’s tightening is having the intended effect.

In short, the Fed appears to have navigated the "soft landing" many feared was out of reach.

Fed Officials: Signaling Patience, But Open to Cuts

The Federal Open Market Committee (FOMC) has adopted a "data-dependent" stance. At recent meetings, Chair Jerome Powell has emphasized the need for confidence that inflation is sustainably moving toward 2% before any rate cuts occur.

Key Notes from Fed Statements:

- Cautious Optimism: The Fed acknowledges progress on inflation but wants to avoid premature easing.

- No Rush to Cut: A mid-year cut remains possible, but likely dependent on continued cooling in inflation and signs of economic weakening.

- Risk Balance: Policymakers are balancing the risk of over-tightening (and triggering a recession) against the risk of inflation re-accelerating.

Market Expectations: Gradual Cuts Ahead?

As of July 2025, markets are pricing in one to two rate cuts by year-end, assuming inflation remains tame and economic indicators soften. Fed futures suggest a year-end fed funds rate in the 4.75–5.00% range.

However, these expectations remain fluid. A surprise uptick in inflation—or a stronger-than-expected economy—could delay or reduce the magnitude of cuts.

What It Means for You

- Borrowers: Mortgage rates, credit cards, and business loans could see modest relief if the Fed cuts later this year.

- Savers: High-yield savings accounts and CDs may remain attractive through the rest of the year, though returns could decline slightly if cuts begin.

- Investors: Lower rates tend to support equities and bonds, especially growth stocks and long-duration assets. But volatility may persist as the Fed calibrates its response.

Bottom Line

The Fed’s interest rate policy in the second half of 2025 is poised to shift from “pause” to “pivot”—but not hastily. With inflation declining and the economy cooling, gradual rate cuts may be on the table. However, the path forward will depend heavily on incoming data.

For now, the Fed’s message is clear: patience and prudence remain the guiding principles.

Kovitz Investment Group Partners, LLC (“Kovitz”) DBA Telemus Capital. Telemus Capital is a division of Kovitz, a registered investment adviser with the Securities and Exchange Commission. SEC registration does not constitute an endorsement of the firm by the Commission nor does it indicate that the adviser has attained a particular level of skill or ability.

The information included herein may contain statements related to future events or developments that may constitute forward-looking statements. These statements may be in the form of financial projections and may be identified by words such as “expectation”. “anticipate”, “could”, “estimate”, “will”, “should” or similar terms. Such statements are based on the current expectations and certain assumptions of the author and are, therefore, subject to certain risks and uncertainties.

The description of products, services, and performance results of Kovitz contained herein is not an offering or a solicitation of any kind. Past performance is not an indication of future results. Securities investments are subject to risk and may lose value.

Trever currently works as a Wealth Advisor whose clients maintain Midwest roots. He helps affluent and emerging wealth families achieve their financial goals and make a smooth transition to retirement. As a trusted advisor for firm’s most complex ultra net worth families he finds work highly fulfilling leveraging his 20+ years of financial services experience.